by John Hunter. This was updated May 2008. See the original - 2005 article.

curiouscat.com > Books > Investment > Library > Mortgage Rates

When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

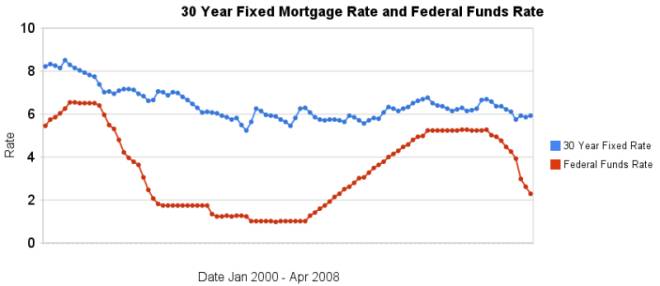

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (data from the Federal Reserve web site, May 2008, for contract interest rates on commitments for 30 year fixed-rate first mortgages: historical rate data - federal funds rate).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates for those looking to lock in mortgage rates. For example, if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do.

30 year rates are largely effected by supply and demand of funds available for long term loans and the anticipated inflation rate. Often the federal reserve lowers the fund rate when the economy is struggling which will also normally mean that the demand for long term loans is reduced - that is the primary reason for some correlation between the rates (not that a drop or increase in federal funds rate causes the 30 year rate to move but that the same economic factor - slow economy, for example, that prompts the federal reserve to lower rates reduces the demand of long term borrowing which can lower the rate of 30 year mortgages).

What is the federal reserve doing when they raise rates? The Federal reserve attempts to maintain stability in the economy by raising rates when they believe future inflation will threaten the economy. In that case, they raise rates in order to slow down the economy and reduce the economic pressures that would lead to inflation.

Could the moves by the Federal Reserve affect 30 year fixed rates? Yes, but what effect cannot be stated with confidence. It can be that the Fed announces an increase in the federal funds rate and then mortgage rates decline. Why? If investors were reluctant to buy long term bonds because they did not believe the fed was taking sufficient action to prevent inflation (for bond investors the major risk is that inflation will reduce the value of their bonds over time) in can be that by raising the federal funds rate investors will believe the fed is taking inflation seriously and will then be willing to invest in long term bonds.

In other instances the rise in the federal funds rate will coincide with increases in mortgage rates and at other times the rise will coincide with no change in mortgage rates. If someone is able to predict with accurate what will happen to mortgage rates they can make large amounts of money by making investments to take advantage of those moves in rates. It is not easy and few make money doing this. This is not for lack of the opportunity to do so, but for lack of the knowledge of the future direction of rates.

See charts for mortgage rates v. fed fund rates for the 1980s and 1990. Chart of 30 year mortgage rates v. fed fund rates for the 2000-2005.